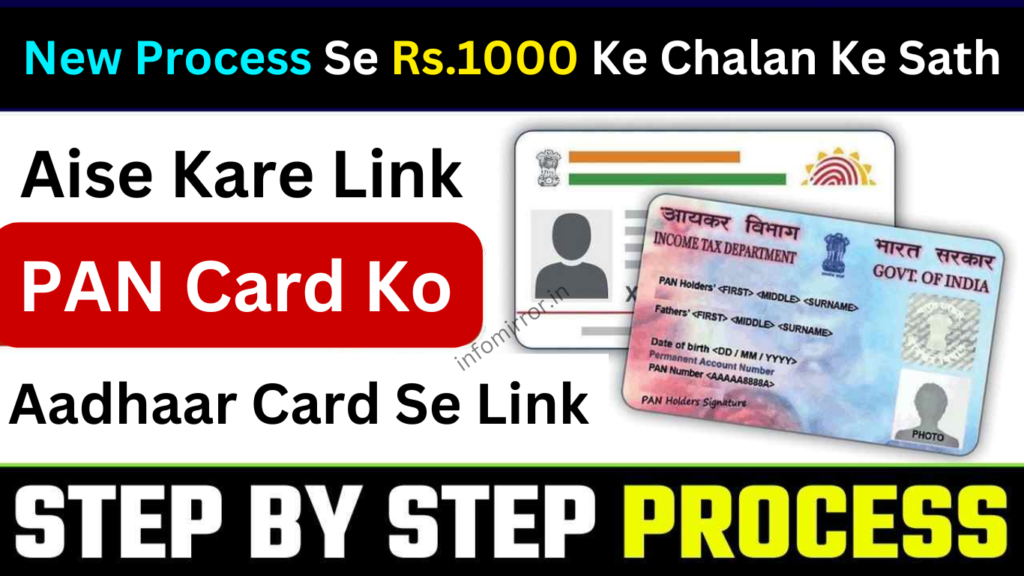

Hello: PAN Aadhaar link karna aaj kal har indian citizen ke liye zaroori hai, lekin kai baar yeh process logon ke liye bahut hi pareshani ka sabab ban jaata hai. PAN Aadhaar link karna aaj ki date mein har ek individual ke liye zaroori ho gaya hai, lekin yeh kaafi time-consuming aur frustrating bhi ho sakta hai. Aaiye iss post ke jariye aapko step by step batayenge PAN Aadhaar Link kaise karna hai|

Section 1: PAN Aadhaar Link Ki Zaroorat Kyun Hai?

Aadhaar aur PAN card ko link karna, Government ke liye ek important step hai, taaki tax frauds ko rokha ja sake. Yeh linkage se:

- Tax Evasion Ko Rukne Mein Madad Milti Hai

- Fraudulent Activities Kam Hoti Hai

- Government Schemes Ko Better Tarike Se Distribute Karna

Lekin yeh process sirf logon ke liye ek formal requirement nahi hai, balki kai log isse kaafi zyada pareshani mein bhi padte hain. Iske piche kai reasons hote hain jaise incorrect details ya internet connectivity issues.

Section 2: PAN Aadhaar Link Karne Ke Liye Eligibility Criteria

Agar aap PAN card holder hain aur Aadhaar bhi aapke paas hai, toh aapko PAN Aadhaar link karne ki zaroorat hai. Lekin, kai baar log yeh nahi samajh paate ki yeh process unke liye applicable hai ya nahi. Agar aapke paas yeh dono documents hain, toh aapko link karne mein koi problem nahi aayegi.

Section 3: PAN Aadhaar Link Karne Ka Process (Step-by-Step Guide)

Linking PAN with Aadhaar kaafi simple lagta hai, lekin kayi baar issues aa jaate hain. Yahaan par hum bata rahe hain step-by-step guide:

- Online PAN Aadhaar Linking:

Aapko Income Tax website pe jaana hoga.- Step 1: Visit the Income Tax e-filing portal.

- Step 2: Select the “Link Aadhaar” option under the “Quick Links” section.

- Step 3: Enter your PAN, Aadhaar Number, and the Name as per Aadhaar.

- Step 4: Submit, and you’ll get a confirmation message.

Section 4: PAN Aadhaar Link Mein Aane Wali Common Problems

Aksar, log PAN aur Aadhaar link karte waqt kuch issues face karte hain. Yeh issues unko frustration mein daal dete hain.

- Mismatch of Name:

Aadhaar aur PAN dono ke naam agar mismatch ho, toh link karne mein problem aati hai. Yeh problem zyada un logon ko hoti hai jinhone apne documents mein spelling errors ya incomplete names diye hote hain. - Mobile Number Not Linked With Aadhaar:

Agar aapka mobile number Aadhaar ke saath linked nahi hai, toh aapko OTP receive nahi hoga aur PAN Aadhaar link karna mushkil ho jaayega. - Aadhaar OTP Failures:

Kai baar Aadhaar OTP ka message nahi aata, jo ki linking process ko rokne ka major reason ban jaata hai. - PAN Details Mismatch With Aadhar:

Agar aapka PAN card details Aadhaar ke saath match nahi karta, toh linking process fail ho sakta hai.

Section 5: PAN Aadhaar Link Na Karne Par Kya Hota Hai?

Agar aap apna PAN Aadhaar link nahi karte, toh aapko tax filing aur government schemes mein issue ho sakta hai. Aapko penalties ya fines bhi pay karne pad sakte hain. Tax return file karte waqt bhi problems aa sakti hain.

- PAN Card Deactivation:

Agar aapne PAN Aadhaar link nahi kiya, toh aapka PAN card deactivate ho sakta hai. - Penalty Charges: 10,000

Aapko Income Tax Act ke under penalty bhi lag sakti hai agar aap PAN Aadhaar link nahi karte hain. - Government Schemes Impact:

Agar PAN Aadhaar link nahi hai, toh aapko government schemes ka benefit bhi nahi milega.

Section 6: Solutions to Fix PAN Aadhaar Link Issues

Agar aapko PAN Aadhaar link karte waqt koi issues aa rahe hain, toh aap kuch steps follow kar sakte hain:

- Aadhaar Details Correct Karna:

Aadhaar aur PAN ke details match karna zaroori hai. Agar koi mismatch ho, toh Aadhaar center ya PAN center pe jaake correct karwa sakte hain. - Update Mobile Number in Aadhaar:

Agar aapka mobile number Aadhaar se link nahi hai, toh aap Aadhaar update kar sakte hain aur phir se try kar sakte hain. - Seek Help From Customer Support:

Agar koi technical issue hai, toh aap customer support se help le sakte hain, jo online bhi available hote hain.

Call to Action (CTA):

Agar aapko koi bhi doubts ya questions hain, toh comment section mein likh sakte hain. Hum aapki madad karne ke liye hamesha yahan hain.

3 thoughts on “PAN Aadhaar Link | Karne Mein Pareshani Ye Galtiyan Sabse Zyada Hote Hai 2025”